In the ever-evolving landscape of finance, where the stakes are high and the uncertainty even higher, many traders are turning to simulated trading as a training ground for their strategies. But how reliable are these virtual results? As individuals wrestle with the temptation to equate simulators with real-world efficacy, it becomes clear that not all that glitters in the digital world is gold.

Simulated trading environments can mimic real market conditions, but they often lack the inherent unpredictability and emotional weight of actual trading. Are these results merely a mirage, offering false reassurance, or can they genuinely serve as a stepping stone to trading success? This article delves into the nuances of simulated trading, exploring its merits and drawbacks, ensuring you have the insights to navigate this complex terrain.

What Are Simulated Trading Results?

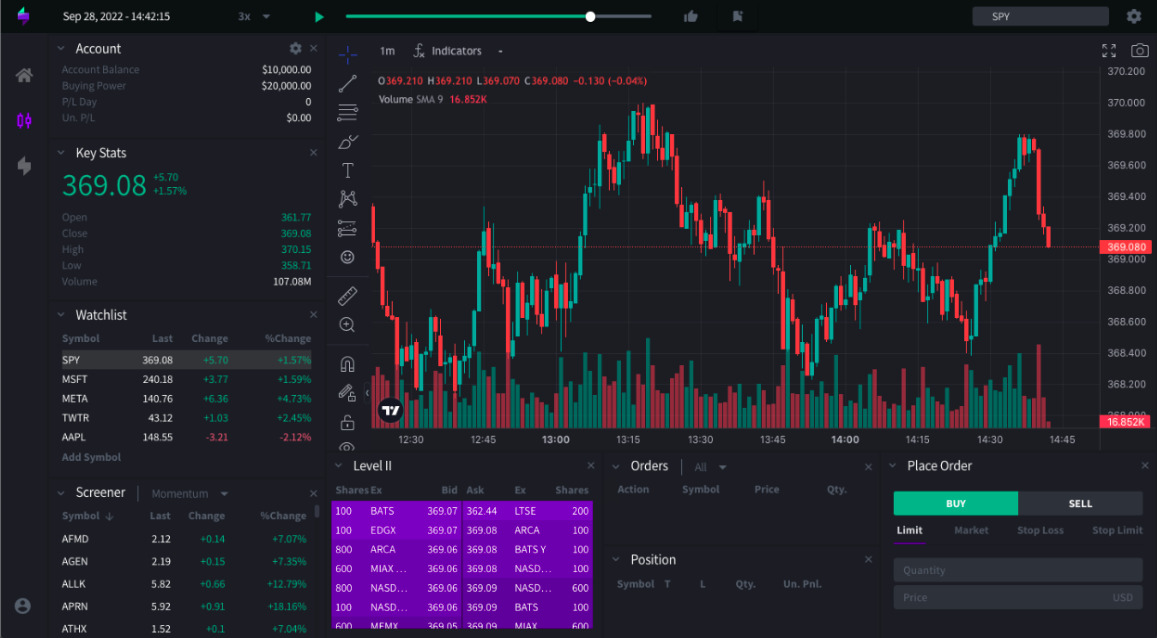

Simulated trading results, often referred to as paper trading outcomes, represent the hypothetical performance of trading strategies executed in a controlled environment without the financial risk that comes with real investments. Platforms like a chart replay free platform enhance this experience by allowing traders to analyze past market scenarios, providing a deeper understanding of strategy performance under various conditions. These results can provide valuable insights, showcasing how specific trades might perform given certain market conditions, asset classes, and time frames.

However, it’s essential to approach these results with a discerning eye. While they can reflect a strategy’s potential, they often lack the emotional and psychological pressures of live trading, which can significantly influence decision-making.

Moreover, simulated trading typically operates under idealized conditions, often neglecting factors such as slippage, transaction costs, and market volatility—elements that can drastically alter real-world results. Thus, while they serve as a useful tool for strategy testing and refinement, one must be cautious in their interpretation of simulated performance, recognizing that past results in a virtual setting may not always translate to future success in the unpredictable arena of actual trading.

The Purpose of Simulated Trading

The purpose of simulated trading is multifaceted, serving as a vital bridge between theoretical knowledge and practical application. For aspiring traders, it offers a safe haven—a risk-free environment where decisions can be tested without the looming specter of financial loss.

Imagine navigating intricate market dynamics, executing trades, and analyzing results, all while your actual capital remains untouched. This simulated battleground fosters not only skill development but also confidence-building, empowering individuals to experiment with various strategies, refine their approaches, and learn from mistakes without real-world consequences.

Yet, the value of these practice sessions extends beyond mere simulation; they mirror the emotional rollercoaster of genuine trading, preparing participants for the highs and lows that accompany true market involvement. In essence, simulated trading acts as both a training ground and a psychological buffer, equipping traders with the tools they need to enter the frenetic world of finance with poise and preparedness.

Benefits of Using Simulated Trading

Simulated trading offers a plethora of benefits that can significantly enhance a traders journey. First and foremost, it serves as a risk-free environment where novices can familiarize themselves with market dynamics without the fear of losing real money. This experiential learning is invaluable; traders can experiment with diverse strategies, refine their decision-making skills, and develop a personalized trading style. Moreover, the data generated from simulated trading allows for insightful analysis.

Traders can evaluate their performance over time, identifying patterns and areas for improvement—something that’s often elusive in high-stakes environments. Additionally, by simulating various market conditions, traders gain confidence in their ability to respond to volatility and unpredictability.

Ultimately, the blend of practice, analysis, and confidence-building provided by simulated trading is an essential toolkit for anyone serious about navigating the complexities of the financial markets.

Conclusion

In conclusion, while simulated trading results can offer valuable insights into trading strategies and market behaviors, they should be approached with caution. The allure of impressive returns in a controlled environment can sometimes overshadow the realities of actual trading, where market conditions and emotional factors come into play.

To enhance your practice and gain a more realistic perspective, utilizing tools such as chart replay free platforms can provide a practical way to evaluate past performance and refine tactics. Ultimately, while simulated results can serve as educational resources, it is crucial for traders to continuously assess and adapt their strategies within the unpredictable landscape of live trading.