In the ever-evolving landscape of financial markets, the journey of an advanced trader often involves navigating uncharted territories, where the nuanced strategies and sophisticated tools can either lead to triumph or tumult. Enter trading simulators—powerful resources that have transcended their basic educational roots to become essential instruments for those seeking to refine their skills and test the limits of their strategies.

These platforms offer more than just virtual trading; they provide a controlled environment where risk can be simulated, market dynamics explored, and psychological fortitude tested. As traders delve deeper into intricate algorithms and advanced analytics, the question arises: how can these simulators elevate your trading acumen? In this article, we will explore the multifaceted capabilities of trading simulators designed for seasoned traders, unveiling the sophisticated features and innovative approaches that set them apart in the digital trading arena.

Prepare to embark on a journey that transcends the mundane and propels you into the realm of strategic mastery.

Key Features of Advanced Trading Simulators

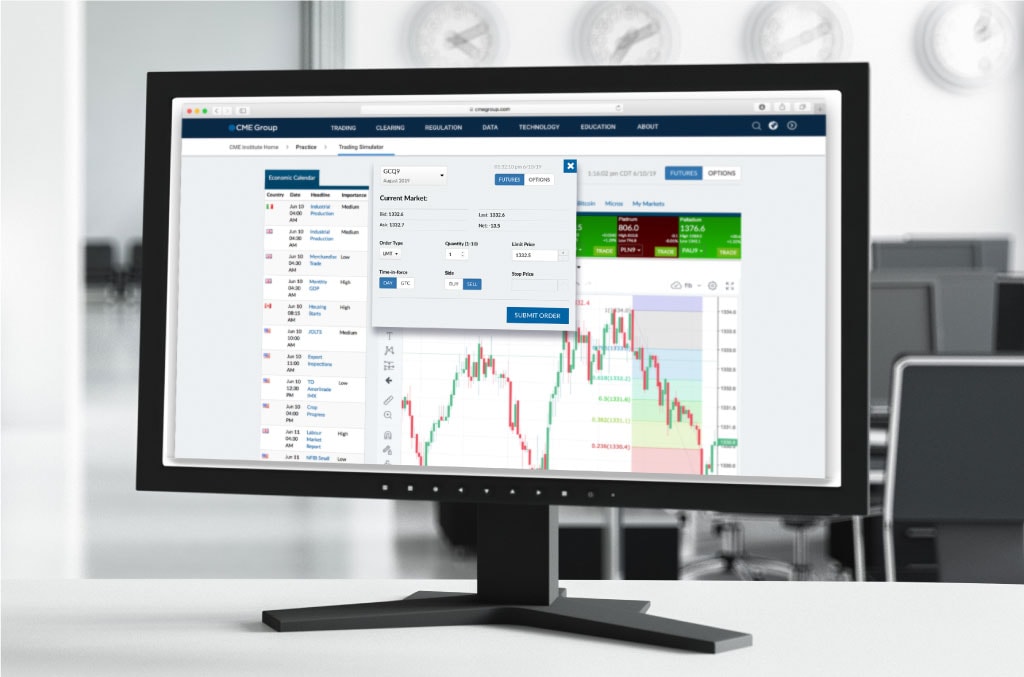

Advanced trading simulators offer a plethora of features designed to cater to the needs of seasoned traders who seek more than just simplicity. These powerful tools incorporate real-time data streams, enabling users to simulate trading scenarios in volatile markets and gain insights into market movements with remarkable accuracy.

Risk management functionalities, such as customizable stop-loss and take-profit settings, allow traders to craft and refine their strategies under various market conditions, reducing the emotional pressure that often accompanies live trading. Replay chart free tool further enhance this experience by allowing traders to review and analyze historical market data as if it were real-time. This capability enables users to test strategies against past market conditions, offering a detailed perspective on how their approaches might perform under different scenarios.

Additionally, advanced analytics and performance tracking tools provide detailed metrics on trade performance, helping traders to identify patterns and areas for improvement over time. With a user-friendly interface that belies their complexity, these simulators not only support algorithmic trading but also facilitate collaboration among traders through shared portfolios and strategy backtesting features, creating a dynamic environment for continuous learning and adaptation.

Integrating AI and Machine Learning in Trading Simulators

Integrating AI and machine learning into trading simulators represents a revolutionary leap for advanced traders, transforming traditional approaches into dynamic, data-driven ecosystems. Imagine a simulator that not only adheres to historical trends but also learns from market fluctuations in real-time, adapting strategies with unprecedented agility.

These sophisticated systems analyze vast datasets—ranging from economic indicators to social media sentiment—unearthing patterns that human traders might overlook. This not only enhances predictive accuracy but also empowers traders to experiment with complex algorithms that mimic high-frequency trading behaviors.

As traders immerse themselves in these simulations, they can test various scenarios, refine their decision-making processes, and gain insights that can only emerge from the fusion of technology and trading acumen. Embracing this convergence, traders can elevate their skills, preparing them for the elusive intricacies of real market conditions, where every millisecond counts.

Future Trends in Trading Simulators

As we look toward the horizon of trading simulators, several exciting trends are poised to transform the landscape for advanced traders. First and foremost, the integration of artificial intelligence and machine learning is set to revolutionize how traders interact with these platforms, offering personalized learning experiences and predictive analytics that adapt to individual trading styles and preferences.

Imagine a simulator that not only tracks historical data but also employs advanced algorithms to forecast market movements, giving users a competitive edge. Furthermore, the advent of virtual reality (VR) and augmented reality (AR) technologies promises to create immersive trading environments, bridging the gap between practice and real-world trading scenarios.

Coupled with enhanced social trading features, where experienced traders can mentor novices in real-time simulations, the future of trading simulators appears not just technologically superior but also increasingly collaborative. As risk management tools evolve and regulatory compliance becomes more intertwined with these platforms, advanced traders will be equipped like never before to refine their strategies and thrive in an ever-changing market landscape.

Conclusion

In conclusion, trading simulators offer advanced traders a sophisticated platform to refine their strategies and enhance their decision-making skills without the monetary risks associated with real trades. By providing a controlled environment in which to test various scenarios, these tools empower traders to build confidence and adapt to market fluctuations.

Among the innovative features available, the replay chart free tool stands out, allowing users to revisit historical market data and practice their strategies in real-time conditions. As the trading landscape continues to evolve, leveraging such advanced tools will be crucial for traders looking to stay ahead of the competition and achieve sustained success in their trading endeavors.